The word hasn’t gained parlance yet, but ‘RoboTaxis’ are likely the future; chipsets and software will process our hands-free, navigational needs and Tesla looks to be leading the way by a large margin.

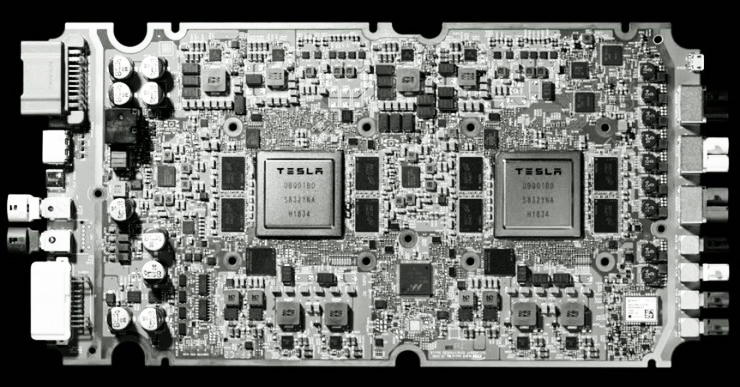

Unlike other announcements from Tesla, the announcement about its RoboTaxis lacked the kind of luster and excitement that a Tesla vehicle unveiling brings for consumers and investors. There wasn’t a dazzling display of flashes from cameras reflecting off the gloss paint of a new Tesla roadster. Instead, Tesla’s new innards were on display (see above photo), and the subsequent news about it was of interest to many including, Nvidia.

With its supposed threat to ride-sharing companies Uber and Lyft, Tesla’s new FSD chipset accomplishes some intrigue and it marks yet another barrier-breaking moment for the company—to the extent that some are calling Tesla a software company. Indeed, as early as November 2017, Trent Eady for SeekingAlpha penned the article, “Tesla Is A Software Company”. In the article Trent states that 60% of Tesla’s employees work in software—a remarkable stat for a car manufacturer—while all other manufacturers have approximately 2% of their staff working in the same regard.

With Tesla’s announcement of its RoboTaxis initiative, the company is solidifying this idea of the above software nomenclature. Also, aside from software, Tesla has also taken the idea of doing what it can to keep things in-house one step further by including hardware innovation.

In the Q&A portion of the ‘Autonomy Day Event’ press release, many of the questions that were asked from the assembly dealt with Tesla’s patent for the new chip technology. To the surprise of many, Musk has made many of his previous Tesla patents open and available to the world—at no charge, no legal repercussion or cost of a licensing fee. Musk’s reasoning is that if brings about a revolution in EV manufacturing, then the world is ultimately better for it.

What Musk also understands, is that this kind of revolution secures the likelihood that Tesla becomes more viable as a car company; if it ultimately helps create and grow the segmented industry that it’s in, the strengthened EV segment ensures, at least in the short term, Tesla’s survival. In addition, despite the sharing of IP, Musk understands the value of an enormous head start, which makes Tesla’s newest innovation all the more difficult for companies to compete against.

THE SEVEN YEAR THEORY?

One simple and astonishing fact that Jeff Bezos credits and points Amazon’s success towards, at least in part, is that for approximately seven years, the company never faced any serious competition; as though the company existed in a vacuum, outside the usual confines of commercial competition. It’s likely for this reason alone, that for the most part, Amazon is a juggernaut. During Tesla’s Autonomy Day Event, Musk stated:

“There is still, in 2019, no car that can compete with the Model S of 2012. It’s seven years later.”

If that statement is true, then what is it that distinguishes Tesla from the rest? Perhaps, it’s that Tesla is a software developer masquerading as an EV car manufacturer. Teslas are vessels for autonomy, the other revolution of transportation. Manufacturing cars, let alone starting a car company, is far more difficult to sustain in an autonomous future. Software, however, is king, and software merged with a computer chipset, is the kingdom. It’s here that Tesla has positioned itself nicely for the coming years.

The fact that Tesla can competitively build a secure chip for FSD in three years is exactly why hardware is a difficult business to be in. Taking into account that Tesla’s current vehicles will be equipped with the chip, Tesla can accrue data in the coming year for its ‘large’, ‘varied’ and ‘real’ datasets which it deems are “essentials” to its neural network. This should have Nvidia and companies like it slightly worried.

Tesla’s partnership with AMD years ago was precisely for this reason, and to have total control of its product, abandoning Nvidia in the process. In theory, Tesla can now license this new technology to other companies, a technology—according to Elon Musk—that is ahead of the curve. This current FSD chipset, if compared to Nvidia’s Xavier Drive is argued to be faster by Tesla. Nvidia released a statement suggesting otherwise, but what is undeniable is that Tesla is now in the chip-making business, as well as the software business, and the EV business.

This should be the perceived threat here, alongside those uttered for Lyft and Uber. Even if the chips are comparable or at least competitive, which Nvidia now admits, Tesla is staking a serious slice out of the autonomous vehicle industry. In then begs the question: what is stopping Tesla from licensing its entire autonomous package—chips to datasets, root to branch—to other car manufacturers?

On the face of it, Tesla’s foray into RoboTaxis appears threatening to Uber and Lyft; however, it also ensures that Tesla will survive and grow in the near term, as the weight of this collective competition—autonomous vehicles eating away at conventional industries—will ultimately overpower all municipalities looking to stem the autonomous tide and the potential losses in revenue (e.g. public transit and parking).

To date, regulation has been the greatest threat to autonomy, but try as municipalities might, certain cities will adopt the technology and it’ll be praised and the dam will break. The takeaway here isn’t necessarily the threat to just Uber and Lyft, or to taxi companies, it’s the new chipset Tesla decided to build in-house, and the coveted software they’re compiling which cuts into Nvidia’s ambitions of dominating this segment.

Nividia issued a response to Tesla’s claims, summarizing by that there are only two legitimate companies with this kind of computing power: Nvidia and Tesla. This might be so, but Tesla is already working on its next generation processor, and who’s to say this can’t be emulated by other car manufacturers looking to reduce costs? Who’s to say it can’t be copied or licensed out?

Consider for a moment that there are many other competitors in the AI chip-making business. Nvidia cannot stay complacent for a moment while the following established and upstart companies nip at their heels:

- Intel‘s ‘Myriad’

- Huawei‘s Ascend 910 and Ascend 310

- AMD‘s MI60

- Google TPU

- AWS Inferentia (Amazon)

- Qualcomm AI

- PowerVR GPUs

*Other companies include startups AlphaIC and Cerebras Systems—Cerebras being the most interesting simply due to its obscurity and the company’s secretive nature.

Nvidia’s video graphic cards are also facing competition from AMD, and if Google’s Stadia is as revolutionary as it sounds for cloud gaming, it should then be noted that Stadia uses an AMD 10.7 teraflops GPU. Depending on who you ask, PC sales are down, but PC gaming sales are still rising and consoles have yet to overtake the PC market.

Technology is very often generational, and there’s a steady growth of youth who are being raised in a PC-less home. Long abandoned by their parents for work laptops and iPads, the PC tower now feels extraneous. At least in the west, clunky PCs and their accompanied games are slowly being replaced by the console as an entertainment hub, and the next generation of gamers is growing accustomed to playing on them. With the upcoming release of Sony’s Playstation 5 and the next generation Xbox, coinciding with Google’s Stadia release (all using AMD chips), it’ll be interesting to see how this battle plays out for gaming and Nvidia in particular.

The myriad of products and areas of innovation that Nvidia is involved in makes it susceptible to the competitive forces that in equal amount desire—in a myriad of strategic design—to innovate. And because much of its product is hardware, anticipate major bumps on many of its future roads. Ultimately, this a Herculean task for CEO Jensen Huang.

Nvidia’s tumultuous year in the markets could worsen and/or be a predictor of future instability, despite its previous successes, as it faces an impending tsunami of competition. It pins much of its prosperous hopes on its GPUs, and patents (to protect them); but like BlackBerry, patents get “borrowed”, and a company’s culture can become stale overnight to the point of near oblivion.

What if Tesla licenses the entire package to other car manufacturers? What if Toyota chooses to disband with Nvidia and adopt Tesla’s technology? What if other car manufacturers follow? What if LiDAR is actually outmoded?

As with much of the tech industry, litigation for patent infringement is now its own high stakes, cut-and-try industry, exchanging powerful legal blows all to the tune of tens and hundreds of millions—or in the recent Qualcomm case, billions. The problem with hardware, is that it’s an unforgiving competitive battlefield with a long history of casualties. Moving forward, Nvidia should avoid the mistake(s) that forces a company to relegate a good proportion of their revenues in this fashion.

Nvidia, on the other hand, have had some competition and to their credit they’ve been successful, but the current love affair that some investors have for it is based on speculation—admittedly, much like the whole of this article. Eventually, even the most dominant, isolated companies face competition, and where there is relentless competition, even the mightiest face the potential of downward trajectory.

Following the ‘Autonomy Day Event’, the subsequent day’s markets thought otherwise to the idea that Nvidia is destined to fall or that Tesla has somehow gained an upper hand, as Tesla’s stock declined, and Nvidia’s climbed.

Time will tell.